📢 HCP Newsletter: Acquisitions, All-Star Interns & Aspiring VCs – January 2023 💫

Harlem Capital’s monthly recap on our portfolio companies, industry news, events & beyond! 🏎️💨

The Headlines 🗞️

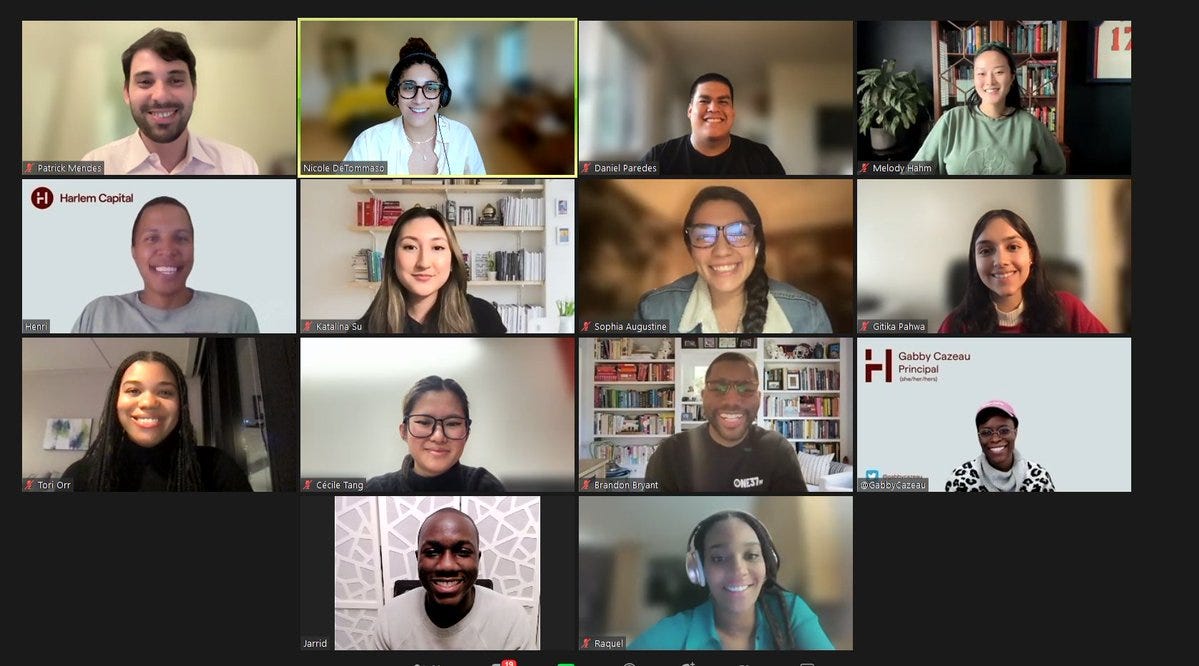

ZOOMing into the New Year with Our 16th Intern Class 🚀

We welcomed 6 new interns to the HCP family — and said hello to two familiar faces who have returned as fellows for the winter 🥳

From the team’s favorite Mexican and Japanese foods to exciting portfolio company updates, this introduction call was definitely a fun one!

Check out our latest blog post for a data deep dive into this Winter 2023 cohort.

🚨 And don’t forget to apply to our Summer 2023 internship by February 7!

Making Sense of the Data 🤯

Let’s face it: data can be confusing, messy, and overwhelming especially for founders with endless metrics and KPIs to keep track of daily.

At Harlem Capital, data is king. It’s the key to making great investments, and it’s also the key to being a great entrepreneur.

Our best founders always utilize the invaluable power of data. But, it can be difficult to present this information effectively and succinctly to your investors each month.

Harlem Capital GP and Co-Founder, Henri Pierre-Jacques, created a one-pager template for founders to highlight their top 5 P&L and KPIs in a very simple way. Download the template here and check out Henri’s Twitter thread. Your investors will thank you later! 😉

Dealing with Down Rounds in 2023 📉

Fred Wilson said it best: 2023’s “new normal will lead to many flat rounds and down rounds.”

As market conditions change, so do VC expectations for a Series A round. Founders may have extended runway and growth in 2022, but haven’t quite reached the metrics for a Series A.

If the startup hasn’t hit the right milestones, founders are now raising flat or down rounds.

If this resonates with you, we have a great resource for you: HCP Principal Gabby Cazeau has a tool to help you understand your flat (or down) Seed-2 round. Check it out here!

“By failing to prepare, you are preparing to fail…” so we hope this tool is useful as we roll into this unexpected year.

Portfolio News 🏆

Healthful Impact 🏛️

Wellory, a platform for one-on-one personalized nutrition coaching, is now in-network with Aetna, Cigna, and Medicare! 🤩

Wellory will also partner with the White House to provide subsidized nutrition counseling to millions of uninsured Americans, as well as employers to remove barriers for individuals seeking care for chronic conditions. Talk about consumer healthcare disruption.

Read more about Wellory’s mission to improve the lives of over 100 million Americans over the next decade here. HCP is proud to be an early investor in this impactful company!

The Baby Collab Of The Year 🍼

HCP portfolio company Expectful, a subscription-based app for fertility, pregnancy, and motherhood, and Babylist, a baby registry and product discovery platform, are both hyper-focused on parental support.

And on January 23, the two officially sealed the deal 🤝

This deal will empower Babylist to change its relationship with its customers and become a larger, health and wellness media platform. Check out the full story in TechCrunch here.

Interested in working at one of the startups in our portfolio? 💻👇

We might be biased, but working at these companies is sure to be an exceptional experience! Search job openings across the Harlem Capital network here.

Harlem Capital Related 🚀

On a Mission 🎯

HCP’s mission is to change the face of entrepreneurship by investing in 1,000 diverse founders over 20 years.

But what about our individual north stars? Everyone on the team drafted their own personal mission statements during our retreat in December. It’s remarkable to see how much overlap there is between the firm’s philosophy and how we as individuals are choosing to live out our lives. Check them out here!

The Next Gen of API-founded companies 💸

Harlem Capital’s podcast, More Equity, hosted by Principal Gabby Cazeau featured Megan Ruan, General Partner at Gold House Ventures in the last episode of the “Diverse Emerging Managers” series.

Megan is an extraordinary investor on a mission to invest capital into Asian and Pacific Islander (API) founded companies through her $30M fund.

Tune into this exciting episode on your next midday power walk here — or if you like matching voices with faces, check out their conversation on YouTube 🎧

Changing the face of emerging managers with TPG 💰

Four years ago, we received an offer from TPG to anchor HCP’s first fund. It transformed our trajectory and we couldn’t be happier to work with them.

On January 10, CalPERS (a.k.a the California Public Employees’ Retirement System) invested $500M into TPG to supercharge their efforts to disrupt the fund manager landscape.

We are elated to be working with TPG. This huge milestone is paving the road for the next generation of diverse fund managers. Dive into the story here!

A Spotlight on Black Excellence in VC 💥

Henri Pierre-Jacques was a featured speaker at IncludedVC’s summit focused on spotlighting black venture capitalists from around the world 🌎

At HCP, we are always seeking opportunities to share knowledge, empower others and change the face of venture capital. Go Henri! 🎉

Building a VC Background with the Best ⭐

Breaking into venture capital is no easy task.

In fact, Nicole DeTomasso broke into Harlem Capital using her creativity and determination. Check out that awesome story here.

Nicole joined an all-star panel with Ashley Aydin of Vamos Ventures and Mike Devlin of Touchdown VC this morning to share best practices for building a VC background, interviewing, and breaking into the industry!

Check out some of these helpful resources ➡️ Break Into VC | VC Interview Tips & Tricks

🚨 Jobs in VC 🧑🏾💻

✨ Check out HCP Senior Associate Nicole’s weekly VC jobs roundup on Twitter👇

✨ BBG Ventures is hiring an associate. Apply here.

✨ Pillar VC is hiring an investor. Apply here.

Save These Dates! 📅

2023 Tech Weeks across the U.S. have been announced! 💥

SF (5/30 - 6/4)

LA (6/5 - 6/11)

NYC (10/16 - 10/22)

Stay in the loop by signing up here.

Helpful Resources 💯

The State of Latino/a VCs: Latinx VC’s 2nd Annual Report

A Pulse Check of the Tech Labor Market: Layoffs.fyi

If you made it this far, thanks for reading! See you all next month for more updates 👋

And don’t forget to follow us @harlemcapital on Twitter, LinkedIn, and Instagram to stay up to date on all things HCP, including upcoming opportunities with the team 👀