📢 HCP Newsletter: Are You a Rocket, Racecar or Bicycle? 🚀 – July 2024

Harlem Capital’s monthly recap on our portfolio, industry news, events & beyond! 🏎️💨

The Headlines 🗞️

🏆 Best in Class

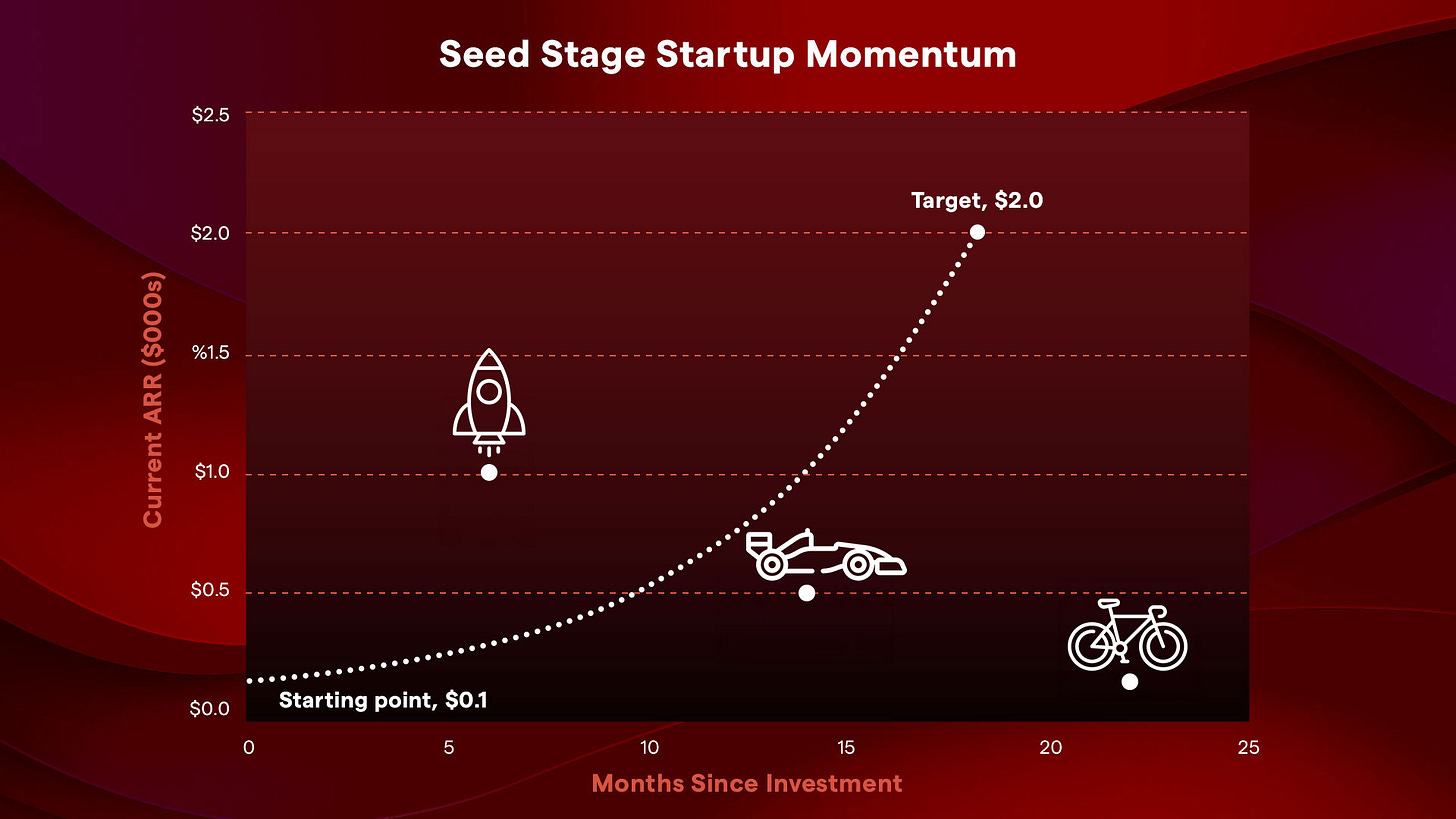

Investors choose companies that they believe can grow, scale, and become strong market leaders. To support this, HCP Partner Gabby Cazeau created a framework for companies to visualize (1) how they are performing against market benchmarks and (2) what investors are looking for. A company, post-investment, can fall into three main categories:

🚀 Rocketship: Your company’s revenue grew quickly by expanding its customer base and increasing ACVs. Focus on building a strong team and have the customer top of mind

🏎️ Racecar: Your company experiences slow growth and is seeing limited customer traction. Prioritize diagnosing company issues and taking thoughtful action quickly

🚲 Bicycle: 22 months later, your company is still having trouble finding PMF and faces challenging dynamics. Conduct honest reflections on the company’s direction and other opportunities

📖 Summer Reading 🤝 HCP Reports

School may be out but learning’s still in session!

In need of some summer reading? Visit 4 of our key reports published during the first half of 2024 focused on diverse unicorns, Black and Latino startups, Vertical SaaS, and AI in manufacturing.

🦄 2023 Diverse Unicorns Report

These 38 Black and Latino founded Unicorn companies raised $20.1B of capital with a median raise of $343.1M. Key sectors in this report include Software, Healthcare, Fintech, and E-Commerce.

⭐ 1,257 Black and Latino Startups That Have Raised $1M+

These companies raised $48.3B of capital with a median raise of $6.7M. The report also features high performing startups and annual funding trends by rounds and industries. Key sectors identified in this report include Software, Fintech, and Healthcare.

🧑💻 Lessons for Vertical SaaS Startups

Vertical SaaS, one of Harlem Capital’s core investment focuses, has shown to be resilient against recent market drawbacks. This report showcases the publicly listed vertical SaaS companies, their enterprise value drivers, and their fundraising trends.

⚙️ Industry Spotlight: AI for Manufacturing Software

AI is becoming key to the day-to-day operations of manufacturers as they streamline processes, increase productivity, and decrease costs. This report includes an overview of AI adoption in manufacturing software, the investment landscape in this vertical, and diverse founder-led AI for manufacturing companies.

⚡ The Untold Power of VC EAs

Our executive assistant, Marini Bacal, plays a vital role in ensuring things run smoothly at Harlem Capital. Marini shares her experience in supporting a VC firm and tips for unlocking efficiencies in our new HCP blog post.

Portfolio News 🏆

🧬 Assemble’s Newest Product Launch: CompGrid Biotech

Assemble’s newest product, CompGrid Biotech, provides tailored life sciences industry data, a simplified submission process, and high-quality benchmarks at a low cost. Interested in accessing CompGrid Biotech’s benchmarks? They are now open for data submissions, which can be accessed here.

📽️ The Box Office Prognosis

Coming off a profitable year, MoviePass CEO Stacy Spikes reminds us that “movie-going is still the No. 1 out-of-home entertainment activity in the world."

MoviePass recently took investment from Comcast's consumer venture group Forecast Labs. And his confidence is well founded, given the box office has heated up recently with a slew of movies that out-performed expectations.

The latest proof point? Disney's "Inside Out 2" became the fastest animated movie to top the $1 billion mark globally, becoming Pixar’s first bonafide hit in years.

Harlem Capital Related 🚀

🎉 Annual General Meeting Recap

We’re still reflecting on the success of our Annual General Meeting last month! Our LPs, founders, and partners joined the HCP team for an engaging discussion of the fund’s vision and strategy. A special thanks to Cadre CEO Ryan Williams and our colleagues at Eniac Ventures and Cowboy Ventures for being an integral part of our day. Watch this year’s AGM highlight reel:

🗽 Harlem Homecoming Highlights

It was special to host this year’s Harlem Homecoming in New York, where our firm was founded. The founder retreat was customized to ensure our founders are set up for success and included tactical sessions on hiring, coaching, and ended with an inspiring fireside chat with Calendly founder & CEO Tope Awotona. Take a peek at our jam-packed summit:

📈 Growth of Fund 1 Companies

HCP MP Henri shares an overview of the scale of our Fund 1 companies here.

Overall, we have seen 66% of companies make $1M+ in ARR and 14% make $10M+ in ARR. When looking at our active companies, 87% make $1M+ in ARR and 27% make $10M+ in ARR. For our companies making $10M+ in ARR, it took them 4 years, on average, to pass that momentous threshold.

🍫 Summer Interns: Deals, Diligence, and Truffles, Oh My!

Our interns are officially halfway through the program! Throughout the 10 weeks, interns are a part of the HCP team where they source deals, conduct due diligence, and focus on their summer projects. This month, our interns also participated in a Q&A webinar with Reach Capital about education trends and had a team bonding event where they made some delicious chocolate truffles!

🚨 Jobs in VC 🧑🏾💻

Jobs at HCP portfolio companies harlem.capital/jobs

Mark Your Calendars – Save These Dates! 📅

🖊️ Inicio Ventures AngelPath Academy – Apply by July 29th

Interested in learning about angel investing? Apply to AngelPath Academy to get fundamental knowledge and skills on angel investing through a bootcamp, weekly knowledge sessions, expert series, and a mentor-supported investment project.

🖊️ Venture Atlanta Startup Pitch Competition – Apply by August 2nd

Finalists will have the opportunity to pitch their startup live to some of the Southeast’s most active funds for their chance at a $500K investment! Finalists will also be receiving mentorship and invitations to investor dinners during the Venture Atlanta Conference.

Helpful Resources 💯

VC Unleashed: The Road to Venture 🛣️

Survey results showcasing the process and sentiments of recruiting in VC

Q2 2024 PitchBook-NVCA Venture Monitor 📊

The state of VC: market overview, growing industries, and investor trends

The Back Office AI Opportunity 🤖

Where can back office functions be optimized with AI?

12 Killer Wedges for Your Company’s Growth 👀

Strategic choices that help orient your company to find its strengths in the market