📢 HCP Newsletter: The Ultimate VC Checklist – April 2024 🏁

Harlem Capital’s monthly recap on our portfolio companies, industry news, events & beyond! 🏎️💨

The Headlines 🗞️

🔎 What are VCs Looking For Right Now? A Lookahead & Retrospective

From founder archetypes to performance proof points, learn what it takes to catch the eye of investors — amid a tumultuous market.

A lot has changed since we wrote “What are VCs Really Looking For” in May 2020. There’s been a boom and bust in the tech market, mass upheaval, and VC funding has slowed down in the last few years.

We’ve weathered those storms at Harlem Capital and grown amid the chaos. We launched our second fund, evaluated over 10,000 companies, invested in 60 companies, and scaled how we support our founders as they accelerate to the next stage of growth.

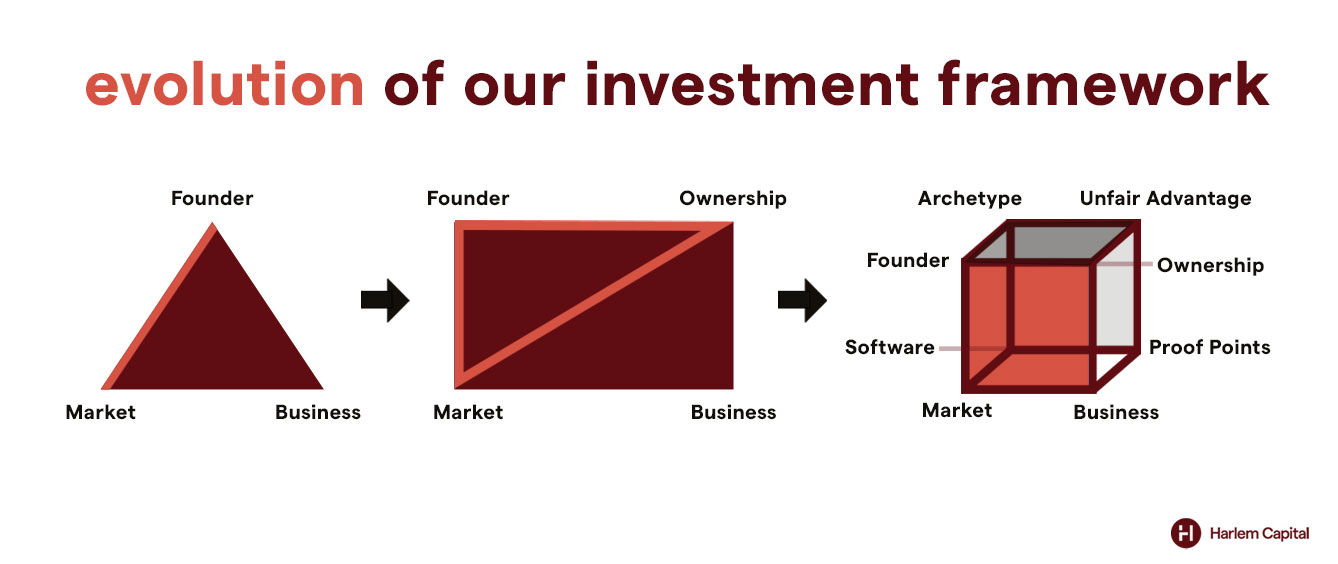

However as the market has shifted, most VC firms have changed how they evaluate companies. Our investment framework has been one of our biggest evolutions too. The HCP box from the May 2020 article is still partially true. But we emphasize a few more things that add depth and dimension to our evaluation of potential investments.

📈 Vertical Software in Public

Vertical software is tailored to specific niche industries. As we work with and invest in vSaaS companies, we wanted to dive deeper into the big lessons startups can learn from public market successes.

We’ve identified 20 notable publicly listed vSaaS companies from which we analyzed annual filing and investor databases to derive insights for vertical software startups.

Tangible Takeaways:

1. Fundraising Trends: Aim for 3-4 rounds of capital before IPO. Be aware of outliers.

2. Revenue at IPO: Median revenue at IPO is $138M and takes about 10 years to reach. Keep that in mind as you think about the path to scale

3. IPO Valuation Realism: Median IPO value is $789M. Target the median fundraising per round over the average.

4. Enterprise Value Drivers: Profitability and mixed revenue streams proved to be great determinants in driving enterprise value for public companies

5. ARR per FTE Correlation: ARR per FTE links strongly with market cap and total enterprise value. Prioritize optimization.

Harlem Capital & Portfolio News 🏆

🤝 The It ‘Factor’ with Primary VC

Harlem Capital is excited to support the Factor Fellowship by Primary Venture Partners! Factor is an initiative to connect exceptional talent from underrepresented groups to careers in New York’s leading startups. The 16-week part-time program connects career changers with diverse backgrounds to in-demand roles at New York’s leading startups. Applications open in May.

🗽 New York or Nowhere

Exciting News! We're proud to have Partner Gabby Cazeau named to the inaugural VC Council for Startup:NYC, a city-wide program by Tech:NYC to support the most promising startups in New York City. Learn more about the community and how to apply here.

🚦 A Sobering Spotlight on ‘Pattern-Breaking Founders’

This op-ed on leadership strategy in Forbes shares some tangible tips for founders who are breaking the mold and building against all odds. A few standouts: go to those who get you and build a team that compensates for known weaknesses. Harlem Capital is featured as a major player in backing diverse founders who have been historically overlooked and underfunded.

🎬 Lights, Camera, Partnerships

Portfolio company MoviePass strikes another exciting collab – this time a multi-year deal with Mastercard. A major win for cinephiles!

🗣️ Hot Takes – Fintech Edition

Gabby joins the popular podcast Fintech Takes with Alex Johnson. Tune in to a wide-ranging conversation about open banking, fraud solutions, shadow banking, and more!

🚨 Jobs in VC 🧑🏾💻

Check out Nicole’s weekly VC jobs roundup here.

Peruse VC Platform roles here.

Jobs at HCP portfolio companies: harlem.capital/jobs.

Helpful Resources 💯

💡 BK-XL: Apply to the 2024 Brooklyn Accelerator

BK-XL’s 10-week accelerator provides underrepresented founders with access to early-stage venture financing, office space in Brooklyn, and ongoing mentorship. Applications open through May 3.

⚔️ NFX: Wartime CEO Leadership Principles

Nine guiding values for every bold CEO running a company today.

🦾 Foundation Capital: AI Leads a SaaS Paradigm Shift

Artificial intelligence’s push into services represents a $4.6 trillion opportunity.

💲 20VC: Are the Best CEOs the Best Fundraisers?

NYC Venture legend Kevin Ryan of AlleyCorp gives us a peek inside his brain.